Air Force Family Separation Pay Regulation

force separation wallpaperA servicemember with dependents who serves an unaccompanied tour of duty or is away from their homeport may be entitled to a Family Separation Allowance FSA of up to 250 a month. This applies to both voluntary and involuntary separation pay.

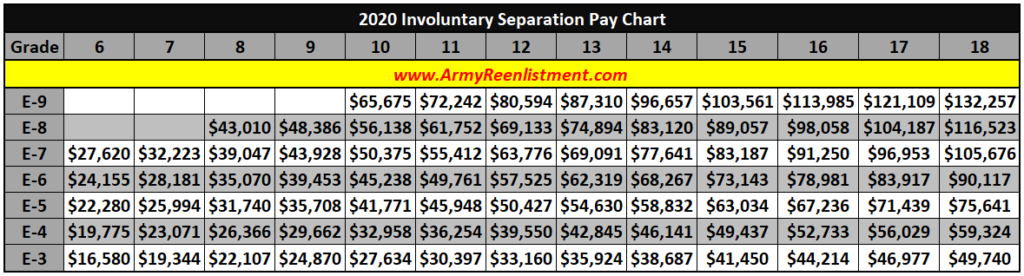

Military Compensation Separation Pay 2020

The amount varies by rank and family status.

Air force family separation pay regulation. Payment begins once the member has been separated from their dependent s for more than 30 days. Navy and Marine Corps Family Support Rules. It is payable to qualified members serving inside or outside.

Normally you can receive DLA only one time per fiscal year. TSP Option for Army Navy Air Force Reserve National Guard. Military offers extra allowances for those who are required to be separated from their familyan enforced separation for mission requirements.

No unfortunately Family Separation Allowance FSA is not authorized in this situation. You may be eligible for other benefits such as Hardship Duty Pay Restriction of Movement HDP-ROM. In the absence of a written agreement or court order adequate support is determined by the individual commander based on the circumstances.

Temporary social visits to the service members duty station may not exceed 3 months. Volume 7A Chapter 27 DoD Financial Management Regulation enforced family separation under one of the conditions in Al through 3 below. FSA provides compensation for added expenses incurred because of an enforced family separation under one of the conditions in subparagraphs 270203A1 through.

Military members continue to receive FSA as long as dependents visit the duty station or port for less than 30 continuous days. Air Force officers and enlistees usually live with their families on or near their home or permanent duty station. These funds are paid only in cases where the military need forces the separation.

The military member is on a duty aboard a ship which is away from the homeport continuously for more than 30 days. Facts must show that dependents are truly visiting. Family separation must be involuntary to receive FSA payments.

It is also important to understand that the voluntary separation of the family will not immediately receive the payment of a family separation allowance FSA. Armys Holistic Barracks Strategy. The application is possible under one of the following conditions.

In other words dependents may not accompany a service member at government expense. A little about pay deductions. The Family Separation Allowance FSA.

House lawmakers want to extend family separation pay to sequestered sailors Sailors prepare to man the rails aboard the USS Carl Vinson before the aircraft carrier departs Naval Base Kitsap in. It can also be pro-rated to 833 per day for periods less than a month. FSA is payable at the rate of 250 per month pro-rated to 833 per day for periods less than a month.

When they are assigned a tour in which their families cannot live with. A military member serving an unaccompanied tour of duty and having dependent family members may apply for Family Separation Allowance of up to 250 a month. FSA accrues from the.

FSA-R - This type of family separation allowance is payable when a member is assigned to a permanent duty station either overseas or in the states where the members dependents are not allowed to travel at government expense. The Department of Defense Financial Management Regulation Volume 9. Separation Pay and VA Service-Connected Disability Compensation.

Air Force Family Support Rules Air Force Instruction 36-2906 Personal Financial Responsibility does not specify a dollar amount for adequate support. The chapter provides policy for FSA. Family Separation Allowance A servicemember with dependents who serves an unaccompanied tour of duty may be entitled to a family separation allowance FSA of 250 per month.

To apply for FSA you should submit a completed DD Form 1561 Statement to Substantiate Payment of Family Separation Allowance FSA to your servicing personnel office. It is important to keep in mind that DLA is intended to partially reimburse relocation. Federal law requires the VA to withhold compensation pay for veterans separation pay severance pay and readjustment pay less any federal taxes already paid.

The Airman is paid Family Separation Allowance on behalf of the dependents that are not visiting or remaining for more than 30 days. Known generally as family separation pay there are two basic types but sorting them out can be a bit confusing.