Fiscal Breakeven Oil Price Imf

fiscal wallpaperIn May 2013 when the IMF staff first projected the countrys 2014 fiscal break-even oil price they pegged it at 88. International Monetary Fund data released on Monday show the worlds biggest oil exporter needs prices at about 85 a barrel to balance its budget this year up from a forecast of 73 in September.

Oil Price War Is More About Market Share Indian Punchline

Oil Price War Is More About Market Share Indian Punchline

The oil price.

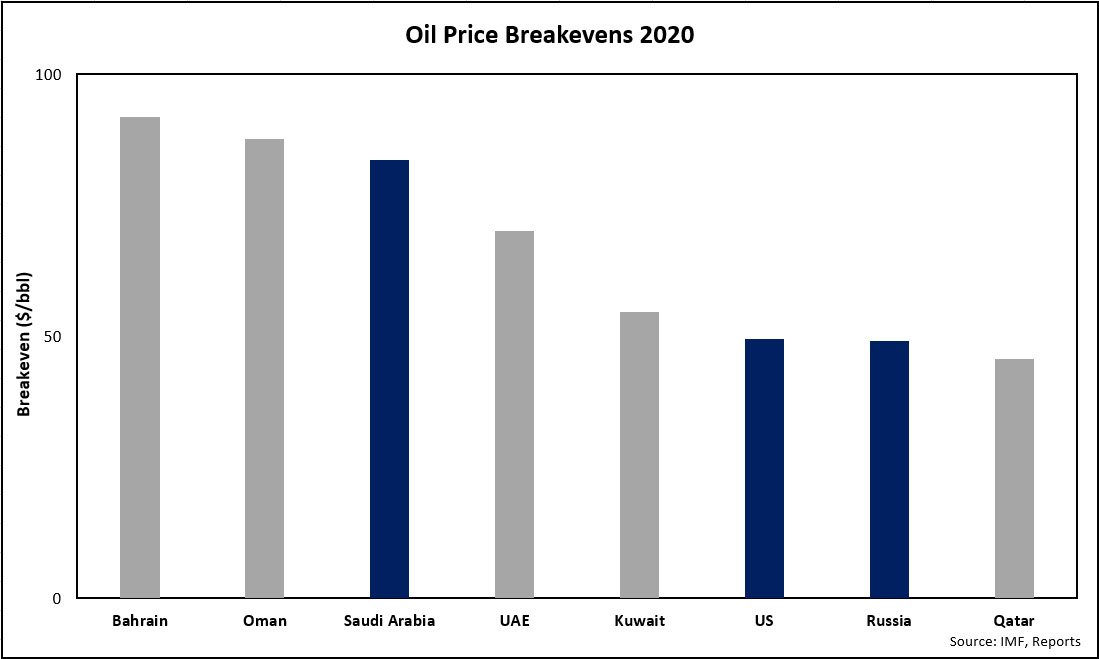

Fiscal breakeven oil price imf. An oil-exporting countrys fiscal breakeven oil price is the minimum price per barrel that the country needs in order to meet its expected spending needs while balancing its budget figure 1. The IMF expects these efforts to raise in the region of 1-2 per cent of GDP assuming a VAT rate of 5 per cent. IMF predicts MENA oil exporters will lose 230 bil in revenue as fiscal breakevens soar.

Once again the International Monetary Fund IMF has made outlandish and inaccurate claims that Saudi Arabia needsabsolutely NEEDSto push the price of oil higher to fund its government. The impact on growth in the Middle East North Africa Afghanistan and Pakistan MENAP region from global headwinds remains muted thus far while growth in the Caucasus and Central Asia CCA region is stable. Breakeven is is the fiscal breakeven the minimum price that a country needs to receive per barrel of crude oil sold for its government to meet its immediate spending needs and balance its budget.

However growth is too low to meet the needs of growing populations while risks to the outlook have increased. For this year if you take the 2019 budget as presented with everything remaining equal a breakeven point would be around 80-85 dollars the IMFs Azour told Reuters. It was only in October 2014 that the IMF staff raised their estimate to 98.

That will force painful spending cuts and extra borrowing. The six Gulf states including Saudi Arabia will face a fiscal shortfall of around 140bn this year if prices average around 30 a barrel. Energy agriculture fertilizers and metals.

Increased vulnerability to a sustained decline in oil prices and intergenerational equity considerations underscore the need for countries to strengthen their fiscal buffers. Read more or Dismiss. Your browser is not up-to-date.

They include global trade uncertainties volatile oil prices. This would lead to much lower fiscal break-even oil prices in Saudi Arabia a. Graph and download economic data for Breakeven Fiscal Oil Price for Saudi Arabia SAUPZPIOILBEGUSD from 2008 to 2021 about Saudi Arabia REO oil government and price.

The database includes a set of country-specific commodity-price based. Use the Commodity Data Portal to visualize and chart the prices of 68 commodities from four commodity asset classes. For optimum experience we recommend to update your browser to the latest version.

More from Europe Doesnt Need a 30 Billion. Share export and download data using the interactive portal. Fiscal breakeven oil prices arent the same as oil producer breakevens but provide a good comparison for countries with national oil companies.

Dubai Middle East and North Africa oil exporters are likely to lose more than 230 billion in crude revenue this year if oil prices persist at current levels while their breakeven oil prices are set to soar amid higher spending needs the International Monetary Fund said in a report on Wednesday. Graph and download economic data for Breakeven Fiscal Oil Price for Kuwait KWTPZPIOILBEGUSD from 2008 to 2021 about Kuwait REO oil government and price. Graph and download economic data for Breakeven Fiscal Oil Price for Kazakhstan KAZPZPIOILBEGUSD from 2012 to 2021 about Kazakhstan REO oil government and price.

Although headline growth has declined because of domestic oil supply disruptions and lower global demand a recovery in oil production is expected to lift growth next year.