Military Spouse Income Tax Exemption Form

form income militaryA state may exempt military income earned while the service member is on orders out-of-state but MSRRA does not automatically extend this exemption to a military spouse. How do I request a refund of the taxes my employer withheld from my wages.

Https Www Nd Gov Tax Data Upfiles Media Form Ndw M Pdf

If you are a resident of california military members that are residents of california must include their military pay in their total income.

Military spouse income tax exemption form. Military Spouses Residency Relief Act MSRRA You may qualify for a California tax exemption under the MSRAA if all of the following apply. Have your personal income tax withheld. You live with your military spouseRDP.

According to the North Carolina Department of Revenue NCDOR tax-exempt status for a military spouse can only be acquired if the spouses domicile is the same state as that of the service member. However the servicemember has been temporarily assigned to a combat zone. Military spouse tax exemption california.

The civilian spouses non-Ohio sourced income is also taxed to Ohio but is eligible for Ohios resident credit if the spouse was subject to and paid tax on the non-Ohio income in another state. Completing Form MW507M If you meet all of the eligibility requirements for the exemption from withholding fill out lines 1 through 3 of Part 1. If youre the spouse of a service member and.

The Military Spouses Residency Relief Act provides that a civilian spouses domicile does not change based only on the civilian spouses presence in a state to be with the servicemember. After 2009 eligible spouses should claim an exemption from Mississippi income tax withholding on a revised Form 89-350 to be filed with their employers. 1 your spouse is a member of the armed forces present in New York in compliance.

Tax year 2017 Military spouse wage withholding exemption. Youre not in the military. Please note the MSRRA exemption only applies to the spouse of the servicemember.

My spouse a Texas resident servicemember was stationed in Kentucky the entire tax year. In most cases you should file taxes in the state where you are earning income but there could be an exception for members of the military and there spouses. Did not submit a Form M-4 MS.

Department of Defense form Residence Certificate State of Legal DD 2058 declaration of servicemembers permanent state of residency Marriage license. The servicemember is still subject to Mississippi income tax on non-military income. If you are a military spouse you may have been told that you do not have to pay North Carolina income taxes due to The Military Spouses Residency Relief Act of 2009.

You can claim a withholding refund by filing a Form 1-NRPY - Massachusetts Nonresident Income Tax Return. An Ohio resident civilian spouse of a servicemember who resides in Ohio is liable for Ohio income tax. Under those conditions your Virginia income tax exemption will still be valid.

Under these conditions the spouse generally will not have to pay income taxes to the current State where income is earned. Be sure to complete the questionnaire on the back of the form and attach the documents requested including your W-2s. Yes if the servicemembers assigned duty station remains North Carolina.

However the following records not inclusive may be requested from the employer or employee to verify the tax exemption if an audit is performed. Youre legally married to the military servicemember. SCRA as amended by the Military Spouses Residency Relief Act and the Veterans Benefits and Transition Act you may be exempt from New York income tax and New York City and Yonkers personal income tax if applicable on your wages if.

What Form Should I File. Youll want to check the tax laws for the state where you earn income if it is different than your home of record. Yes if the income exceeds the amounts shown on the Filing Requirements Chart of the income tax instructions Form D-401.

Forms and Paper Filing. Does not allow military spouses to retain their drivers license in their state of legal residence and is silent about vehicle registrations inspections or insurance. Form M 4 Ms Download Printable Pdf Or Fill Online Annual Withholding Tax Exemption Certificate For Nonresident Military Spouse Massachusetts Templateroller.

Are exempt from Massachusetts taxes. Filing Refund Claims I qualify for exemption from Virginia income tax under the Military Spouses Residency Relief Act. This should help you determine your state tax filing requirement.

The spouse of a servicemember has met the conditions to qualify for the exemption. Fillable Online Revenue Ky Form K 4m Nonresident Military Spouse Withholding Tax Exemption Revenue Ky Fax Email Print Pdffiller A military servicemember s non resident spouse eligible to claim an exempt new mexico withholding status based on the veterans benefits and transition act of 2018 must annually submit form rpd 41348 to an employer or payor responsible for withholding new mexico tax. Request a Copy of a Tax Return.

Servicemembers Leave and Earnings Statement LES Servicemembers Form W-2. Use Form 763-S to request a refund. The california constitution and revenue and taxation code section 205 5 provides a property tax exemption for the home of a disabled veteran or an.

Fix or Correct a Return. A military spouse who qualifies for military spouse relief should file a new Form K-4 with his or her employer to claim the exemption from withholding of Kentucky income tax. Estates Trusts and the Deceased.

Spouse Adjustment Tax Calculator. Under the Act a spouse of a servicemember may be exempt from Georgia income tax on income from services performed in Georgia if. The MSRRA changes the basic rules of taxation with respect to military spouses who earn income from services performed in a State in which the spouse is present with the Service member SM in compliance with military orders when that State is not the spouses domicile legal residence.

This is not entirely true. Your military spouse must have permanent change of station PCS orders to California. Spouses military ID card.

Can the spouse continue to exempt all income earned for services performed in North Carolina. The servicemember is present in Georgia in compliance with military orders.

Tax Quotes Humor Tax Quote Taxes Humor Tax Season Humor

Ar Ms Tax Exemption Certificate For Military Spouse Fill Online Printable Fillable Blank Pdffiller

Http Www Hawaiipublicschools Org Doe 20forms Military Militaryspousetaxexemption Pdf

Gaar Forces Wealth Managers To Stop Specialist Tax Advice Http Www Iexpats Com 2012 05 Gaar Forces Wealth Managers To Stop Filing Taxes Tax Lawyer Tax Time

Pin On Teen Tax Tips Personal Finance

Form Va 1 Claim Yourself 1 Unbelievable Facts About Form Va 1 Claim Yourself Unbelievable Facts Unbelievable Facts

What Is Irs Tax Fraud Tax Evasion What Are The Penalties Irs Taxes Tax Fraud

How To Fill Out A W 4 Form Without Errors Pt Money Employee Tax Forms Tax Forms W4 Tax Form

Money And Taxes Filing Taxes Tax Write Offs Tax Debt

Https Www Langston Edu Sites Default Files Basic Content Files Oklahoma 20tax 20commission 20w 4 Pdf

Edb General Info Section B11 Required Forms For New Hires Tax Forms Employee Tax Forms Business Letter Template

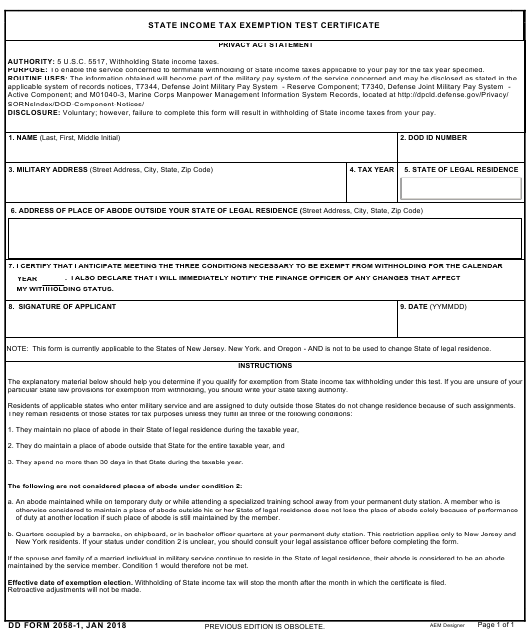

Dd Form 2058 1 Download Fillable Pdf Or Fill Online State Income Tax Exemption Test Certificate Templateroller

Da 31 Fillable Zrivo Zrivo Military Money Irs Finance Tax Da 31 Fillable In 2020 How Many Days Fillable Forms Informative

When You Get To The End Of March There Are A Bunch Of Tax Forms That You Should Have From People Do You Ha Personal Finance Budget Personal Finance Tax Forms

Irs Form Ss4 Ein Employer Identification Number Tax Preparation Income Tax Return Federal Income Tax

Https Azdor Gov File 4986 Download Token Lavdn9je