Imf Oil Crisis

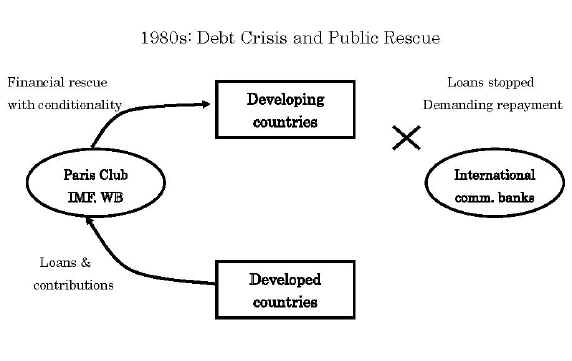

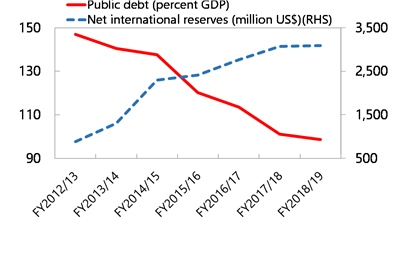

crisis wallpaperThe IMF projects that the economy of Algeria with high debt levels and a nearly empty sovereign wealth fund that was valued at more than 70 billion just seven years ago to contract by 52 this year and grow by a miraculous 62 in 2021. Debt and painful reforms 198289 The oil shocks lead to an international debt crisis and the IMF assists in coordinating the global response.

Money Matters An Imf Exhibit The Importance Of Global Cooperation Reinventing The System 1972 1981 Part 2 Of 7

Money Matters An Imf Exhibit The Importance Of Global Cooperation Reinventing The System 1972 1981 Part 2 Of 7

The answer is yes and no.

Imf oil crisis. Supporters of presidential candidate Yaku Perez representing the Indigenous party Pachakutik take part in a campaign rally in Quito Ecuador Wednesday Feb. The IMF has presented a very bleak outlook for an economic recovery in the Middle East and Central Asia predicting a 41 contraction for the region. Both events resulted in disruptions of oil supplies from the region which created difficulties for the nations that relied on energy exports from the region.

Channels of economic impact Heres what we know. In a sign of just how severely Nigerias economy has been affected by the coronavirus pandemic and the oil price crash Africas biggest crude producer this week warned of an imminent recession. Voters in Ecuador are.

Because of the war the Organization of Arab Petroleum Exporting Countries OAPEC declared an oil embargo against the United States and the Netherlands - countries judged too friendly to Israel. Societal Change for Eastern Europe and Asian Upheaval 19902004. Omans economy likely shrank 64 percent in 2020 the International Monetary Fund said on Friday due to the coronavirus crisis and low oil prices putting a strain on the states coffers.

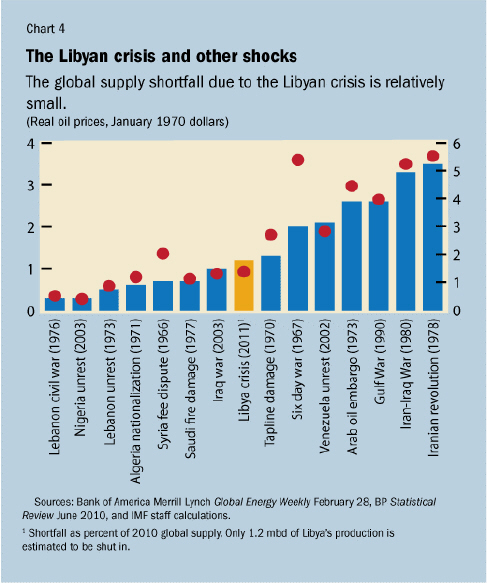

The IMF responded to the challenges created by the oil price shocks of the 1970s by adapting its lending instruments. The oil crisis of the 1970s was brought about by two specific events occurring in the Middle-east the Yom-Kippur War of 1973 and the Iranian Revolution of 1979. Did the war cause the oil crisis.

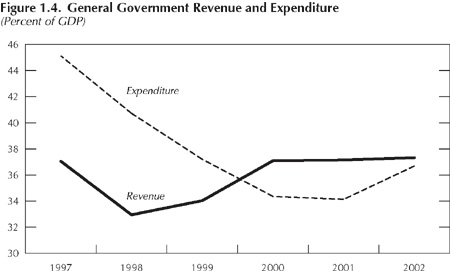

Chads economy where about half of government revenues and 90 of exports come from the oil sectoris projected to shrink by just over 02 this year and grow by 61 in 2021. The 1976 IMF Crisis was a balance of payments or currency crisis in the United Kingdom in 1976 which forced James Callaghan s Labour Party government to borrow 39 billion 175 billion in 2019 from the International Monetary Fund IMF at the time the largest loan ever to have been requested from the IMF. During 1973 oil crisis IMF estimated that the foreign debts of 100 oil-importing developing countries increased by 150 between 1973 and 1977 complicated further by a worldwide shift to floating exchange rates.

The main driving factor behind this bearish. The intertwined shocks are expected to deal a severe blow to economic activity in the region at least in the first half of this year with potentially lasting consequences. As a result oil prices have fallen by over 50 percent since the start of the public health crisis.

Oil shocks occur in 197374 and 1979 and the IMF steps in to help countries deal with the consequences. The 1988 annual meetings of the International Monetary Fund IMF and World Bank were met with an international protest in West BerlinWhereas the organizations earlier meetings were met with smaller national protests the 1988 meetings attracted protesters internationally against what was the largest assembly of the international monetary order since the 1944 Bretton Woods Conference. To help oil importers deal with anticipated current account deficits and inflation in the face of higher oil prices it set up the first of two oil facilities.

From Wikipedia the free encyclopedia. The embargo caused severe energy shortages over the winter of 1973-74. Omans economy likely shrank 64 in 2020 the International Monetary Fund said on Friday due to the coronavirus crisis and low oil prices putting a strain on the states coffers.

Redirected from 1976 IMF Crisis Jump to navigation Jump to search. Today IMF is faced with a set of significant challenges at various levels that are partially caused by the increasing forces of globalisation recent global economic crisis increasing level of uncertainty in the global economy emergence of new economic superpowers from East and a range of other reasons. The commodity itself has fallen by 50 this year and the IMF expects the UAEs economy to.

The oil crises of 1973 touched off by the Arab oil producing countries created a most serious balance of payments problem for the developed as well as developing countries. Among the developing countries India was the most severely hit. Jihad Azour director of the IMFs Middle East and Central Asia department noted a large disparity in economic loss between oil importing and exporting countries as the region has been hit by the.

Even after more than half a centurys experience overseeing national and international economic affairs the key financial institution responsible for preserving the stability of the global economy the International Monetary Fund hereinafter IMF or the Fund was unable to prevent or even forecast the worst financial crisis since the 1930s Livingston 2009. IMF administered a new lending program during 19741976 called the Oil Facility. According to the IMF oil exports are expected to decline by more than 250 billion across the region.

How Gold Helped South Korea Repay Its Debt

Imf Survey Central America Aims For Stronger Growth

Imf Survey Central America Aims For Stronger Growth

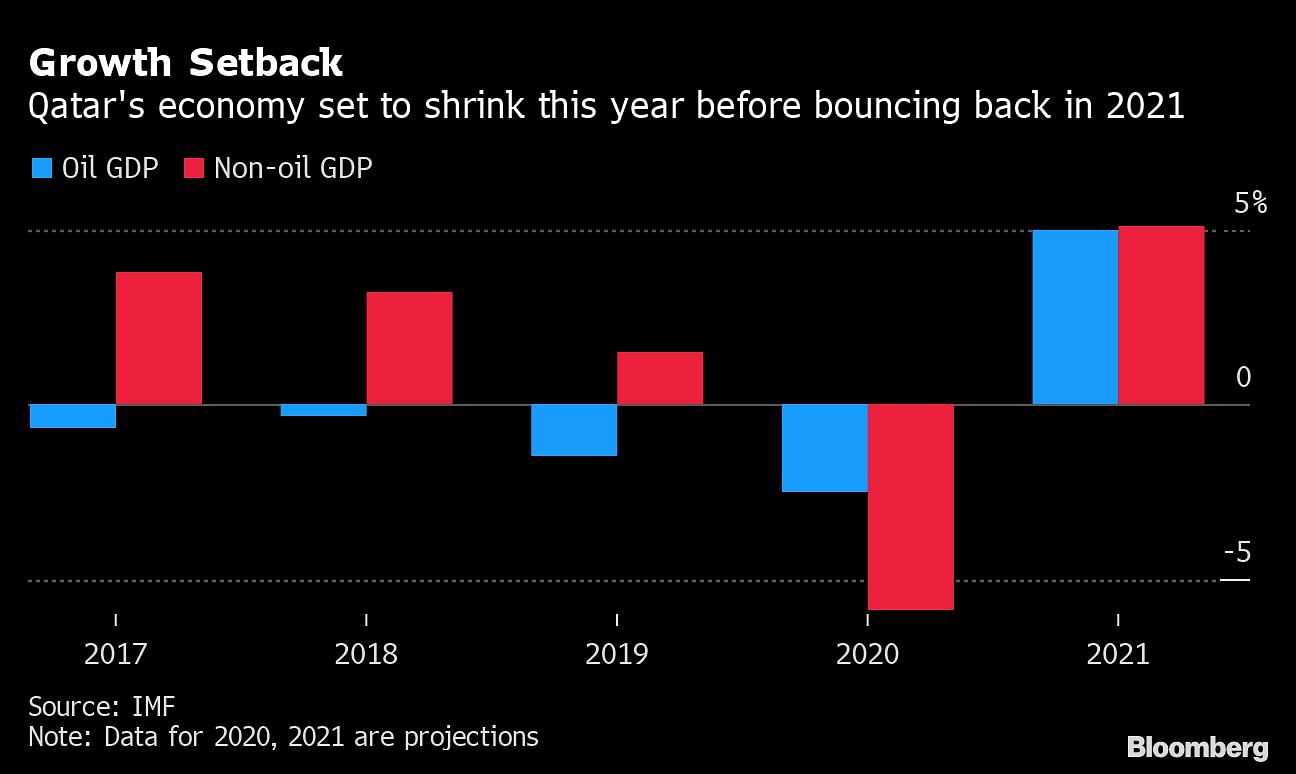

Imf Believes Qatar Can Pull Of A Budget Feat Only Few Countries Can

Imf Believes Qatar Can Pull Of A Budget Feat Only Few Countries Can

About The Imf History The End Of The Bretton Woods System 1972 81

About The Imf History The End Of The Bretton Woods System 1972 81

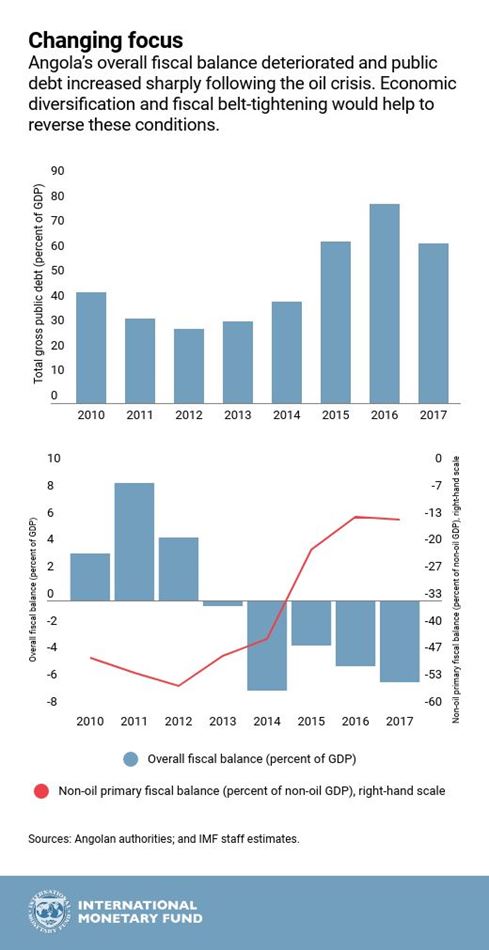

Imf Optimism And Oil Dependent Countries Be Wary Of Sunny Projections

Imf Optimism And Oil Dependent Countries Be Wary Of Sunny Projections

Finance Development September 2001 Was Suez In 1956 The First Financial Crisis Of The Twenty First Century

Finance Development September 2001 Was Suez In 1956 The First Financial Crisis Of The Twenty First Century

Chapter 1 From Great Depression To Great Recession An Overview Excerpt From Great Depression To Great Recession The Elusive Quest For International Policy Cooperation

Chapter 1 From Great Depression To Great Recession An Overview Excerpt From Great Depression To Great Recession The Elusive Quest For International Policy Cooperation

How The Covid 19 Crisis Differs From The Economic Crises In The Past Pqe Group

How The Covid 19 Crisis Differs From The Economic Crises In The Past Pqe Group

The Impact Of The Financial Crisis On Imf Finances Bulletin September Quarter 2010 Rba

The Impact Of The Financial Crisis On Imf Finances Bulletin September Quarter 2010 Rba

Why Cheap Oil Fails To Boost The Global Economy Imf View Vox Cepr Policy Portal

Imf Urges Governments To Maintain Support As Covid 19 Restrictions Worry Markets As It Happened Business The Guardian

Imf Urges Governments To Maintain Support As Covid 19 Restrictions Worry Markets As It Happened Business The Guardian

The Challenge Of Moderate Commodity Prices In Latin America Blog Dialogoafondo